41 Best Alternatives To Paypal For Online Payment

When someone mentions online payment services, PayPal is always on top, which can process more than USD 150 billion worth of payments each quarter. It is super easy to use and this is considered a secure way to help you send money while you are purchasing items as well as services online; however, PayPal also won its downsides. Luckily, there are various online and mobile payments available to your own business and your customers. In this article, you will be shown Top 41 Best Alternatives To Paypal For Online Payment.

Why would you want to choose Paypal alternatives?

You might be asked a question about you would want to choose Paypal alternatives. Following is several drawbacks to payment solutions that you can take into consideration:

-

PayPal does not offer protection for sellers to sell digital services and products.

-

There are PayPal alternatives that charge lower fees than PayPal’s 3.7 percent adding USD 0.30.

-

PayPal is known to have the ability to freeze the accounts for a maximum of six months without any warning.

-

It might take a long time to get your money withdrawn to your own bank account. From three to five days can become standard.

-

While PayPal is free for individual uses, it still receives a piece of cake when the business is here. With each transaction getting involved in services and goods, it will take around 2.9 percent. Losing about 3 percent of each transaction will make your customers add up fast as the business grows. Apart from those charges, banks need to ask for the transaction fees to the transferring finds. The banks also own charge-back fees of around USD10.

-

PayPal is also notorious for getting accounts froze without noticing anything. If the algorithm reveals any kind of suspicious activity in your own account, PayPal will continue as well as freeze the account, followed by the funds in it. For instance, you will see that there are several flagging criteria witnessing a surprising surge in its own transaction volume and items sold at lower prices or any vague and questionable products sold.

-

Let’s consider its widespread acclaim, and there is a fact that a username and password will protect your financial data. Besides, PayPal is among the most attractive targets for any scammers. They can use different platforms such as email and Twitter, where their fraudsters can pose as PayPal’s affiliates, or the customers can support the staff as well as phish for the PayPal credentials.

-

It can take up to 5 working days to get the funds withdrawn from your own Paypal accounts, which can cause difficulties to swallow in case if you are having trouble with tight finance.

Hence, if you already asked yourself: “What can I use instead of Paypal?”, then you will be covered.

41 Best Paypal Alternatives For Online Payment

As you might not know about, in the second half of 2018, PayPal already owned more than 240 million active accounts in the world. The platform creates a favorable condition for over 17 million businesses and provides the users with a reasonably transparent fee structure. Then, what will happen if you wish to discover alternatives to PayPal?

In case you want, you might be in the situation:

-

Seller protection for digital items

-

Lower fees for the chargebacks

-

Faster turnaround for getting PayPal funds withdrawn

-

A more hands-on customer success team

In this part, you will be shown more than 40 best alternatives to Paypal for online payment.

1. WePay

WePay provides you with integrated payment for many platforms. It is designed to activate immediate onboarding as well as keep processing with the JPMorgan Chase scale. WePay focuses on unique online, omnichannel software platforms, and POS. It allows businesses to get the transaction embedded, along with payout capability with an integration.

-

Implementation: Developer documentation

-

Pricing: Request available

2. 2CheckOut

If you are looking for a real global option, consider 2CheckOut since it gives you about 8 payment types, 87 currency options, and 15 languages in over 200 global markets. They also offer you a mobile-friendly experience with the branding being customized to your own business.

You will also have chances to enjoy around 300 fraud rules each transaction, easy integration, and higher PCI compliance with over 100 online carts, followed by extensive documentation.

-

Implementation: Developer documentation

-

Pricing: 2SUBSCRIBE, 4.5% + $0.45 per successful sales; 2SELL, 3.5% + $0.35 per successful sale, and 2MONETIZE, 6.0% + $0.60 per successful sale.

3. Authorize.net

Authorize.net will accept credit card and electronic payments personally, online, or through phones with the payment gateway service. Authorize.net has been working with many small businesses since 1996. Besides, it takes advantage of more than 43,000 merchants, facilitates USD149 billion payments annually, and control over one billion transactions.

It is a subsidiary of Visa as well as sold through the resellers, consisting of Independent Sales Organizations, financial institutions, and Merchant Service Providers. Its customers will receive a free and 24/7 support, along with award-winning API integration. Also, Authorize.met integrates with Apple Pay, Visa Checkout, and PayPal, which enables its users to accept customer payments around the world if your business is located in Canada, the United States, the United Kingdom, Australia, and Europe.

-

Implementation: Developer documentation

-

Pricing: All-in-One Option, no setup fee, free monthly gateway, 2.9% +.30 cents per transaction; Payment Gateway Only, no setup fee, monthly gateway $10, .10 cents + a daily batch fee of .10 cents; Enterprise Solution, tailored pricing, data migration assistance, interchange plus options.

4. Skrill

Skrill enables you to send as well as collect money, link bank accounts, store cards, and make payments with your own email address, along with the password. Skrill “wallet holders” pays only fees of 1.45 percent so that you can get to keep more money from each transaction. No matter you are using Skrill for personal use or business use, you will be given access to the support in over 30 countries.

-

Pricing: Opening personal accounts are free, with more information on transaction fees.

-

Apps: iOS / Android

5. Intuit

QuickBooks Payments allows you to get paid twice as quickly in case you are using their own services. They enable you to take the mobile card payments, install recurring billing, and send invoices online. Also, you will receive real-time alerts as the customers pay invoices or view invoices. Payment reminders are automated. It all appears in QuickBooks in the rea;-tome without getting any adjustments from you.

-

Pricing: When you begin, you can start to pay. USD0/ month, Bank transfers (ACH), free, Card-Swiped, 2.4 percent + 25 cents each transaction, Card-invoiced, 2.9 percent + 25 cents, Card - Keyed, 3.4 percent + 25 cents

-

QuickBooks Payments for Web Store: Pay when you go with $0/month; Pay monthly, $20/month; Swiped qualified rate, 2.4% pay when you go or 1.6% monthly; Keyed qualified rate, 3.5% or 3.3%; Transaction fee,30 cents for pay when you go and monthly.

6. ProPay

ProPay gives you good payment solutions for lots of small businesses, various industries, and company businesses, consisting of auto dealers, direct selling, and legal. They can create favorable conditions for credit card payment, along with payment processing. Also, it gives you commission payment options and global disbursement.

ProPay provides you with payment solutions for the SaaS platforms, software providers through pay-by-text or “one-click,” email payments, and marketplaces.

-

Implementation: Developer documentation

-

Pricing: Request available

7. Dwolla

Dwolla gives itself a pride because it is developer-friendly and integrated with your own application. They consist of a white-label API that allows your consumers to interact with the interface which they trust. Note that customer identity is well-verified without the involvement of the third-party, and bank accounts can be easily added.

Dwolla will help automate your current payments as well as send you the maximum of 5,000 payments with an API request. Besides, it can boast a 99.9 percent uptime, predictable pricing, sophisticated security, and a helpful supporting team.

-

Implementation: Developer documentation

-

Pricing: Start plan comes early 2019 with USD 2,000 per month, scale plan, pricing available based on the request, and an enterprise plan.

8. Braintree

Braintree is a real PayPal service. Braintree Marketplace, Braintree Direct, Braintree Extend, and Braintree Auth provides you with payment solutions customized to the unique needs of your own business. They can make online, and mobile payments become easy in over 130 currencies and more than 45 countries. Adding Hosted Fields to their Drop-in UI means that your own users can take advantage of a checkout experience.

-

Implementation: Developer documentation

-

Pricing: Standard pricing, 2.9 percent + 30 cents per transaction with custom pricing available based on the request.

9. Stripe

If you are running an online business, Stripe is definitely a good choice. They are the first developer companies believing that payment is an issue rooted in code, but not finance. When it comes to Stripe, you can have Stripe up as well as run in a few minutes with easy API.

-

Implementation: Developer documentation

-

Pricing: Pay as you go, 2.9% + .30 cents/successful card charge, + 1% on international cards; 0.8% and a $5 cap on ACH debits; Custom pricing available based on request

10. Payoneer

No matter who you are: a freelancer, a business owner, and a professional, Payoneer can help you get paid fast, at a low cost by international clines, and securely. They can focus on a diverse market, and industries; hence, it does not matter if your online companies are concentrating on online advertising, eCommerce, and vacation rentals. Payoneer owns 4 million users in over 200 countries and can deal with your business with ease. All you need to do is sign up for your account at Payoneer, start receiving your online payments to your Payoneer account, and withdraw your fund from your local bank or the ATMs from the world outside.

-

Implementation: Developer documentation

-

Pricing: Payments from other Payoneer customers, free; Receiving accounts using Payoneer’s Global Payment Service, free; Payments directly from your customers, 3% on credit cards in all currencies and 1% on e-checks; Payments via other marketplaces and networks, pricing varies

11. Amazon Pay

Amazon Pay contains portals for charities, merchants, and shoppers. Your own customers will easily use it since they are able to log in by using their own Amazon account information, then checking out by using the similar Amazon process they believe.

In addition, you can receive further security of Amazon’s protection at no cost. All of the transactions are well completed on your own site. After that, Amazon will integrate with your current CRM. It is available for devices so that you are able to control payments on the way.

-

Implementation: Developer documentation

-

Pricing: 2.9 percent + 30 cents per domestic U.S. transaction, 3.9 percent for cross-border processing fee with USD 20 for disputed charges.

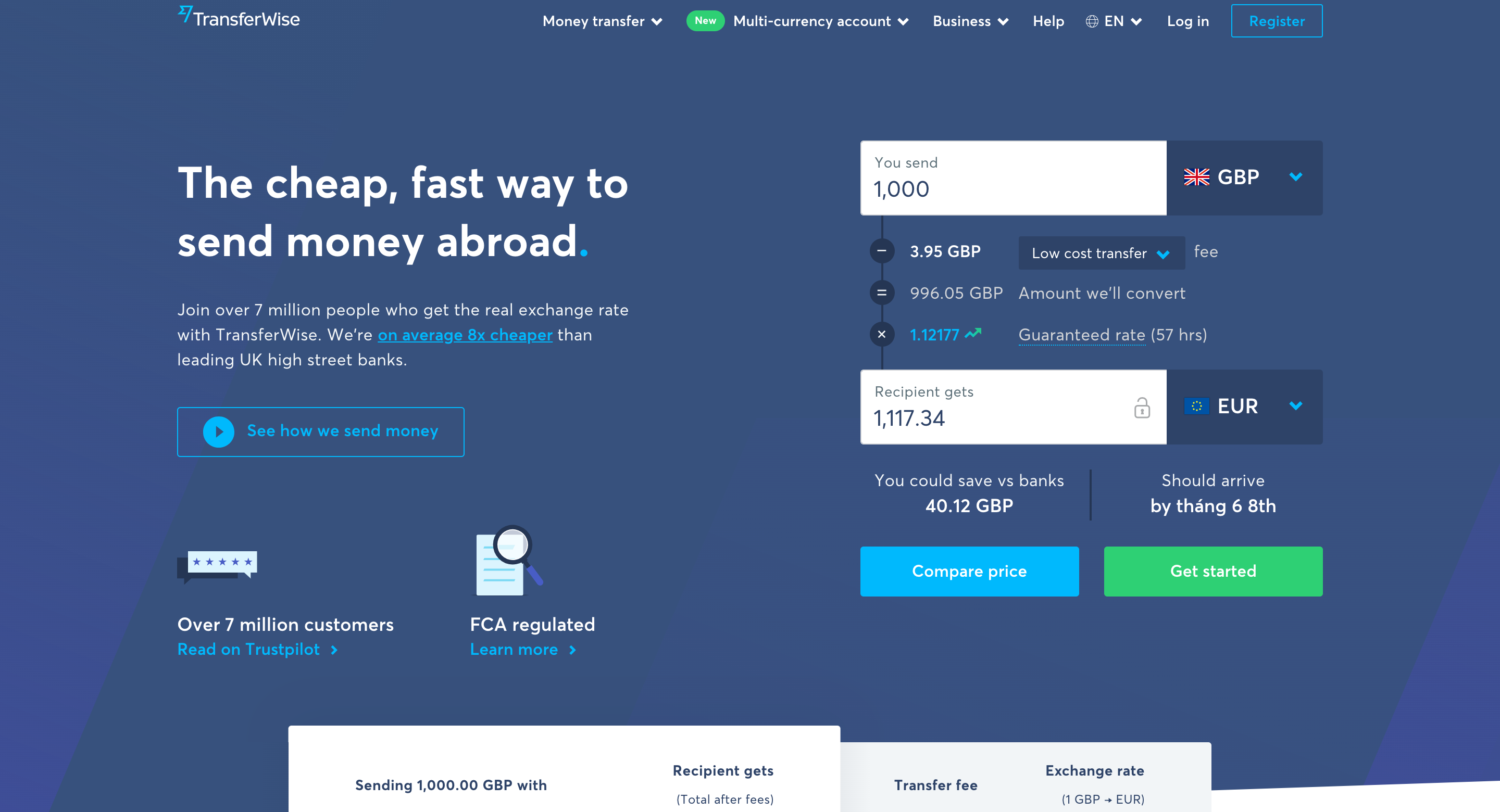

12. TransferWise

TransferWise is known as a very cheap way to help money to be sent internationally. When it comes to TransferWise, you can send as well as receive money, and join the waitlist for the TransferWise debit card, get paid as a freelancer, run batch and payroll payments, and explore the API payouts. Additionally, TransferWise also consists of the fairest exchange rate, ban hidden fees, and finish 90 percent of transfers from the United Kingdom to Europe in a business way. In case you implement a high level of international transactions, TransferWise is a must-try for you to check out.

-

Pricing: View fee structure

-

App: iOS / Android

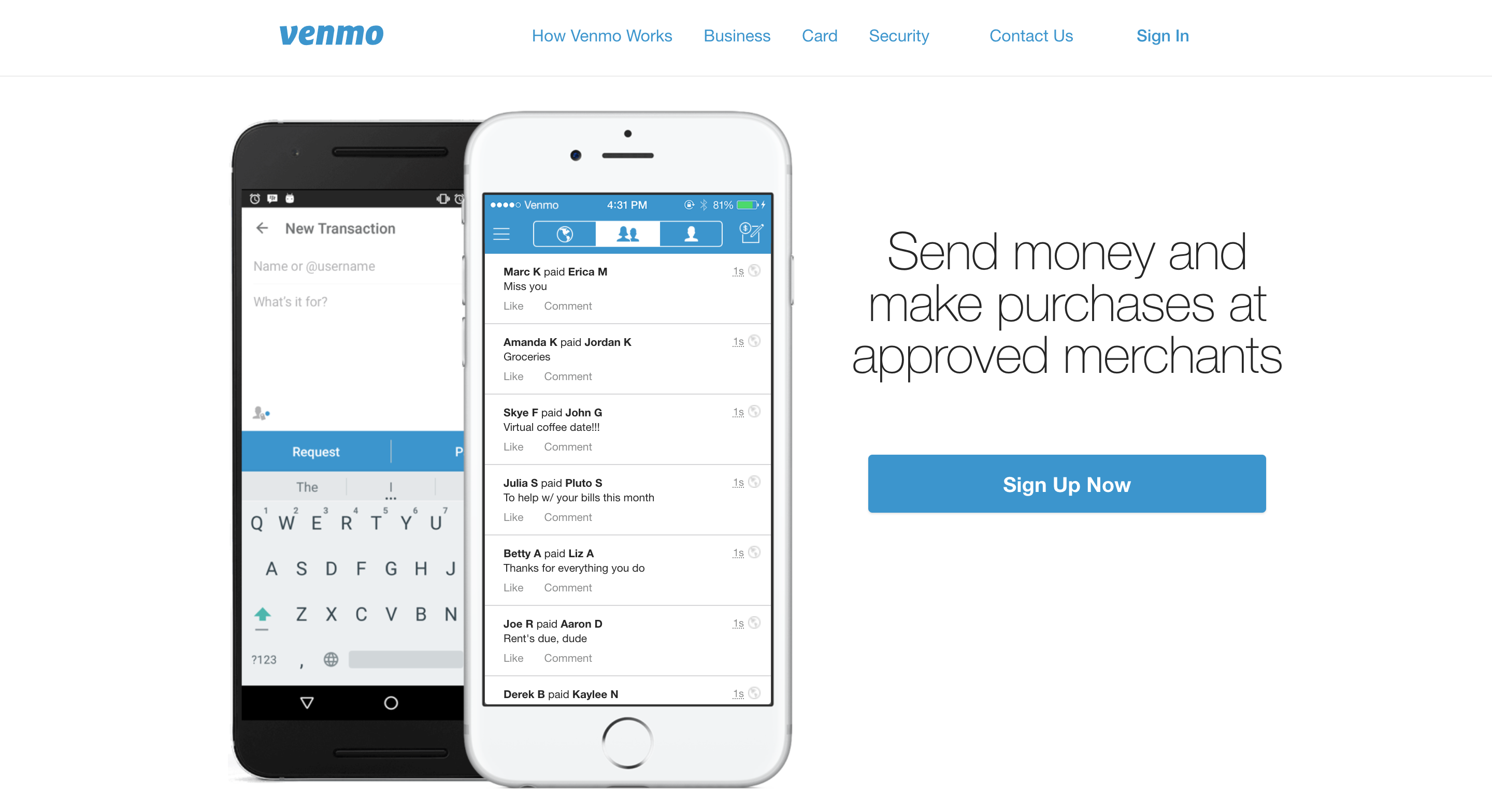

13. Venmo

You might know or not know Venmo. Venmo is widely used to aid you in paying friends back for concert tickets and pizza; however, you did not know Venmo could work for business transactions. You can insert this platform into your mobile site and app, then using Venmo’s social benefits as additional marketing for the business. You might need to integrate with PayPal Checkout or Braintree to use Venmo as the payment options; however, should the social aspect of the payment surprise you, Venmo is worth looking.

- Apps: iOS / Android

14. Square

You are allowed to set your desired business size, type, and sign up for Square. They can work best for the retail addition to in-person transactions before offering two major plans. You are enabled to accept cash, check, cards, and gift cards. Additionally, it can print and send receipts digitally, recurring payments, process invoices, and take time for real-time inventory management.

Also, you will receive a big bonus. You can get your cards swiped without connecting; hence, you will not need to worry about getting your business lost from the outages. Square for Retail enables you to sell quickly with the search-based point of sale, adjust, track, transfer inventory, manage your vendors, and generate customer profiles with each sale. By the way, you can create goods, sell reports, set up the employee time cards and permissions, and send purchase orders.

- Implementation: Developer documentation

15. Payline

Payline supplies items that are suitable for your business no matter you are in-store, online, or mobile. Payline is loaded with various partnership selections allowing you to get your plan customized.

- Implementation: Developer documentation

16. Shopify Payments

Credit cards are accepted with Shopify with no involvement of any third-party. You can easily track your balance as well as payment schedule from convenient store dashboards, then getting email alerts as new funds are coming in your bank account. In addition, Shopify POS can make it possible to get credit cards accepted no matter you are in a retail store or on the way.

Also, Shopify supports Pinterest Buyable Pins, Facebook Messenger, eBay, Amazon, Facebook shops, and Enterprise-level accounts.

- Pricing: With Basic Shopify, USD 29 per month, in-person credit card fees of 2.7 percent + 0 cents, online credit card rates of 2.9 percent + 30 cents. 2 percent of extra fees for non-Shopify payment suppliers, Shopify with USD 79 per month, in-person credit card fees of 2.5 percent with no cents, online credit card rates of 2.9 percent, Advanced Shopify,1% additional fees for non-Shopify payment providers, online credit card rates of 2.4% +.30 cents, in-person credit card fees of 2.4% + .0 cents, and 0.5% additional fees for non-Shopify payment providers.

17. Worldpay

Terminal or online with your payment methods does not matter with Worldpay. Worldpay can create favorable conditions for EMV chip card payments and provide alternative payment selections in card-not-present situations. Their motto is “Turn your online payment options into a strategic advantage.” Then can perform with a specific concentration on aiding you to grow your own business through the strategic payment processes.

-

Implementation: Developer documentation

-

Pricing: Available based on request

18. Wirecard

Wirecard is known as one of the best options if you are a focused business. Wirecard is connected with over 200 international payment networks as well as work with more than 100 transaction currencies. With in-store payment, risk management, mobile payment, value-added services, and integration are just among the services they are offering. In case you require a multiple channel payment gateway, Wirecard can be your solution.

- Pricing: Available based on request

19. BlueSnap

You will get an amazing gateway solution with BlueSnap. Besides, it provides you with a merchant account and sets of features to aid you in growing your own business. Take note that BlueSnap offers intelligent payment routing that can provide you with payment analytics, chargeback management, optimized conversion, risk management, and its ability to process over 100 global payments. BlueSnap can integrate with many platforms you are using, such as your shopping cart, CRM, and ERP systems to make your implementation a breeze.

-

Implementation: Developer documentation

-

Pricing: No monthly fees for maintenance in the first year. After the first year, monthly fees will be waived in case your transaction volume is bigger than USD 2,500 per month, Visa/Mastercard Corporate/Discover/Diners, 2.90% +.30 cents; Visa/Mastercard debit, $2% + .30 cents; Visa/Mastercard credit, 2.70% + .30 cents; Custom pricing available upon request, American Express and non-U.S. transactions, 3.70% +.30 cents.

20. Merchant Inc.

As you can see, Merchant Inc. is quite different from PayPal in some ways. Firstly, funds are directly deposited in your account, which gives you full protection. You can fight disputes directly when they are in the grace period. You can bear no cost for setup fees and application, with debit and credit cards being accepted on the website. Consumers do not need PayPal accounts. You will receive payment in a couple of days. PayPal will help you take up to 21 days to make your funds available. You also need to get those funds transferred to your bank account. Last but not least, Merchant’s Advanced Fraud Detection Suite enables you to get your filter customized and manage managing how fraudulent and suspicious are well controlled.

- Pricing: Retail discount debit rate as low as 0.35 percent, transaction fees, 0.25 cents per transaction, qualified discount rates for Internet, mail, or phone.

21. Viewpost

Viewpost allows us to send as well as track customized and professional invoices. It accesses payment discounts for bigger control over the working capital. Also, Viewpost can save your time with full-featured billing and payment solution working no matter whether you are freelancers or enterprises.

-

Pricing: USD 14,99 per month with transaction fees (available based on request)

-

Apps: iOS / Android

22. FastSpring

FastSpring focuses on firms working over content, software, and apps online. They allow you global subscriptions, along with payments for the digital enterprises, along with integrating with digital items you really ask for growing your own businesses. FastSpring provides you with omnichannel distribution enablement with a highly personalized eCommerce shopping experience, subscriptions, recurring billing, and popup checkout for the customers. FastSpring can create favorable conditions for global payments with tax management support and localized experience.

-

Implementation: Developer documentation

-

Pricing: Available based on request

23. Quickbooks Payments

Quickbooks Payments are well supplied by Intuit. Along with that, the payment solutions can work best when used in the accounting software Quickbooks. This PayPal alternative can carters to medium to small businesses, then concentrating on offering intuitive and simple financial tools with quick transactions. With Quickbooks Payments, you are allowed to generate and send invoices. After that, you can setup recurring billing, accept ACH bank transfers, taking mobile card payments with automated payment reminders. Apart from that, you can link your bank account with Quickbooks to make accounting become easier so that you do not need to enter data manually. Quickbooks Payments allows you to connect payments with timesheets and payroll.

-

Pricing: QuickBooks Payments contain different pricing plans that rely on your own requirements. The basic pay-as-you-go plan can offer you free bank transfer. Card payment can charge at 2.9 percent, with an addition of USD 0.25.

-

Apps: iOS / Android

24. Klarna

Klarna helps you analyze a person’s potential risk fast, which is based on the details, transaction history, and time of purchasing. It can approve or refuse your purchasing in some minutes before ordering fulfillment follows. Then, customers will be given 14 days to get the payment cleared. This means that when customers are shopping, most of the arising risks will be covered by Klarna. Another way of saying is that Klarna is involved in your whole process of eCommerce order fulfillment. More interestingly, you do not need to sign up with service connecting with your banking directly. Instead, you are allowed to proceed with your own standard online banking details with authentication. Payment is right away transferred to your merchant account.

Pros:

-

Customers are enabled to buy items and complete their payment after shipment

-

The checkout process is easy

-

Shoppers can pay for their orders in installments

-

Customers do not need to pay for things when items are returned

-

Merchants are paid by Klarna based on the checkout

Cons:

-

Purchases can be refused without any reason

-

Klarna’s customer support is not responsive

-

Customer refunds can take for a while

25. Apple Pay

Apple is competing Google over mobile payments since Apple Pay can hit iPhones around the world in 2014. Recently, Apple Pay has been beyond. Apple Pay is not restricted to the iPhone. You are allowed to use Apple Pay from Apple Watch and your iPad.

Apple Pay lets you upload debit, credit, and store loyalty cards with NFC payment terminals. Furthermore, Apple Pay can make it easy to pay your family and your friends for your bill sharing or send your children with some bucks if necessary. You can send someone your money if they do not have installed the Apple Pay app. However, installing Apple Pay is necessary if you want to access and cash-out money to debit cards.

26. WeChat Pay

WeChat Pay is known as one of the most popular digital wallets, followed by payment services that are available to WeChat users. Even though China includes a higher number of WeChat users, it has developed in popularity in the world. The development is as part owing to Chinese users in various countries to introduce the app to another. Like other, WeChat has integrated with other Tencent services, consisting of social media websites with gaming platforms.

Apps: iOS / Android

27. Google Pay

Google Pay is widely regarded as Google Wallet and Android Pay, which becomes Google’s mobile payment processing selection. In the current iteration, Google Pay is known as an all-in-one mobile payment system, and you can take advantage of it to make payments for your friends, supermarket shop, or at the local bar. Google Pay’s digital wallet includes credit, debit, and loyalty cards, which allows you to make payments by making use of the smartphone’s NFC chip. Right now, Google Pay is concentrating on making mobile payments easy. It enables you to send money to everyone with email addresses and phone numbers no matter you are not a real Google Pay user. Along with that, the recipient can cash out instantly to debit cards and a bank account to grant instant access to your own money.

-

Download: Gmail for iOS / Android (free)

-

Download: Google pay for Android / iOS (free)

28. Facebook Messenger Payment

Facebook Messenger Payment is easy to use. Besides the ability to find your friend in the Messenger app, add your amount, and select Pay, you are allowed to send and get money from your family and friends without arising fees. Additionally, there will be a good chance for your friends who already have a Facebook account. You can send them money through an app with no requirement of extra tools, but still keeping the whole process of payment simple and fast.

29. Popmoney

When it comes to Popmoney, it enables you to send, ask, and get money online or on your own mobile devices. With businesses, this tool is the most useful for those working closely with certain clients. The service belonging to Popmoney consists of pricing at 95 cents each transaction.

30. Paymate

Paymate’s merchant service lets you accept the online payments of credit card both in person and over phones. This service greatly supports various currencies and offers dispute resolution, along with support services.

31. Paysera

Paysera can provide you with cheap money transfers and a platform to accept online, followed by mobile payment. Remember that registration is free, and merchants can pay fees for some services such as e-banking and checkout.

32. PayLane

As you might not know, PayLane is an online payment processing solution, especially for SaaS, as well as an eCommerce business. It enables your businesses to support payments in a variety of currencies and formats.

33. Selz

Selz lets your businesses to get payments from online stores and social media platforms processed. You are allowed to make use of Selz to generate your own online storefronts or supply products for sales on your social media. After that, you can process payments through Selz or take advantage of payment platforms Selz is competitive with PayPal.

34. Avangate

Avangate is known as a payment solution focusing on software developers. The price will heavily rely on your own plans and particular needs for your own businesses.

35. PayJunction

Payjunction is known as a platform allowing online merchants to get credit card payments from your customers quickly.

-

Electronic and Email Signatures: They are following the online process system. This means that the demand for minimal hardware, along with minimum setup fees. With this wonderful function, you can collect digital signatures from your own customers to eliminate the requirement to store receipts.

-

Developer Friendly: PayJunction provides its users with a a developer-friendly stack API, then allowing online merchants to make their platform more customizable and flexible if the need arises.

-

Callin Processing: If you cannot send your own payments on mobile apps, you are able to avail Call-in processing methods. All you need to do is making calls through automated systems as well as get the transaction recorded at no time.

36. Traditional merchant account

Getting merchant accounts from banks provide you with the capability of directly accepting credit card. A traditional merchant account offers you a monthly fee and you have to comply with PCI Council security standards. But, in case you are doing lots of businesses and require to get payment solutions integrated into your own system and shopping cart.

Besides, you can ask your own local bank on the merchant accounts or implement research to check if there is any online solution fitting your own needs. You have to ensure to find out reputable providers that do not own records of bad customer service. If you do a volume of online businesses or are happy with using other services to get your payments processed, you do not need to worry about getting merchant accounts.

37. AliPay

Alipay is very popular in China. When it comes to settlement time, Alipay will settle funds that can reach and exceed more than USD 5,000; then, the total amount will be widely transferred to merchants’ bank accounts. Registration requisites include Valid Business Registration Document, Shareholder and primary contact person, ID certificates of Legal Representative, Vaid URL to carry out AliPay. This business kind must be compliant with all of the applicable laws to meet AliPay requirements. In addition, AliPay supports SMS verification services with full, partial, and multiple refunds, Payment Shield, and a real-time risk controlling system.

When the funds are deposited into your own account, it cannot become frozen. There are no disputes in the case of Alipay employing the “Escrow” system. Funds are released right after buyers confirm the product’s receipt, and complaints are not raised in 7 days of shipment. Alipay’s terms of services can offer merchants the freedom to manage their own accounts and funds.

38. ACH credit and direct debit

Automated Clearing House (ACH) credit transfers allow customers to get money transferred from bank accounts to merchants’ bank accounts, which are registered in the United States. It is known as one of the most popular methods of payment between B2C and B2B businesses with the average order value. On the other hand, direct debit lets merchants gather money from the U.S customers’ bank accounts directly. The method is widely used by SaaS, along with subscription-based businesses. You can accept funds in USD; then you have to have a US/USD bank account.

Although AHC payments do not include any retrieval and chargeback fees, as customers can dispute transactions with banks, then the sole options merchants have is going to the court to justify why they can get accounts debited. One more thing to remember is while card transactions are declined for the insufficient funds, ACH debit transactions can take up to 24 hours to get insufficient funds notification. Regarding pricing, the cost varies, relying on merchant account providers, payment service providers, and payment processors you can use to help get ACH payment processed. They can charge from USD 0.25 to 0.75 each transaction or from 0.5 percent to 1 percent for every transaction. Several processors might charge an extra fixed monthly fee.

39. SEPA direct debit

The European Union will come up with SEPA, known as the Single Euro Payments Area. It is an integrated payment solution to directly simplify the debit bank transfers denominated in Euro among member countries. In this situation, online merchants might need to use customers’ bank account details in the International Bank Account Number or Bank Identifier Code format to get a transaction initiated. Then, customers have to get merchants authorized to debit their money from their own account.

Take note that you are able to process SEPA payments in-house or make use of third-party processors. You will have to require bank accounts in the SEPA Zone, known as a Unique Creditor Identifier, then getting the bank to accept the Click Mandates. There are several security measures containing the use of BIC and IBAN in order to initiate transactions, along with identification UCI merchant use.

Although SEPA ensures banks are not able to deduct transferring amounts, some processors such as financial institutions as well as banks do not include any option to get extra fees for direct debit transfer charges. When it comes to major customer compliments, as the amount is taken back from customers’ bank accounts, the delay only happens when the bank transfers funds to the merchant’s account. This quick settlement process can decline the financial costs, then improve your cash flow. Apart from that, the risk analysis is well conducted in real-time in order to weaken fraudulent transactions.

40. Giropay

Giropay is loaded with a free installation of around €99. This is a fixed charge per month of around € 5.9, a transaction with maximum of 0.89 percent of your sales, and verification fee of € 0.49 each verification. Giropay is very popular in Germany, and you only need to spend from 1 to 2 working days for settlement time. Take note that customers need to have their own bank accounts or at least a savings account in affiliate banks to get payments processed via Giropay. This payment can support only one currency; hence, it cannot be applied for international payments. As you can see, with the help of real-time transaction confirmation, merchants are able to get payment guarantees from customers’ banks. Apart from that, chargebacks are not allowed. When it comes to registration requisites, if your customers want to pay in an online shop with Giropay, you might need an acceptance contract. The sales team with its partner GiroSolution can provide you with online application forms that can be filled out. Furthermore, about 16 percent of total online transactions in Germany will be processed via Giropay with 40 million German customers who are using Giropay to make payments.

41. iDEAL

This ideal payment service supplier is able to charge you a transaction fee from € 0.10 to € 0.70 for each transaction. iDEAL can might or might not charge an extra fixed monthly fee. This tool is the most common in the Netherlands and its settlement time is from 1 to 2 business days. Regarding security, iDEAL can operate in this participating banks’ online banking sites, and it makes use of similar security methods, such as two-factor authentication. Additionally, sensitive data including card details are not shared with any merchants.

Like Giropay, iDEAL can work well on Dutch domestic transferring systems; hence, it can solely be used by Holland and Netherlands citizens who are owing bank accounts in participating banks. You should bear in mind that payments are made from familiar online bank environments and customers do not need to share their own card details with their merchants. This amazing payment tool can notify you of your real-time payment confirmation that does not get involved in the interchange percentage. Also, chargebacks are not supported by iDEAL.

In case you allow your customers to pay through iDEAL, you have to agree with iDEAL contracts with a qualified Payment Service Provider. It means that they can give various kinds of subscriptions or contracts for iDEAL. All you need to do is to choose subscriptions or contracts that suit the way you are running for businesses. CPSP or the bank can support on this. As you agree on the iDEAL contract, your own PSP will take you to the Merchant Integration Guide. Those documents will describe technical specifications for getting iDEAL integrated into your own online checkout systems.

Conclusion

After this guide on Best Alternatives To Paypal For Online Payment, we hope that you can have many choices for your best PayPal alternatives for the businesses. In case you have your money sent between your family and your friends, you can select among 41 Best PayPal Alternatives mentioned above. Take notice that Apple users might want to use Apple Pay, typically because it can integrate well with iOS and Apple items. With Android devices, you can go with Google Pay offering the same service without Apple’s restrictions. If you find this whole post useful, don’t forget to help us share it on your social media.

Related Posts:

New Posts