Best Payment Gateways for Shopify (for Dropshipping, US, UK, India, Australia)

In the 21st century, people have been more and more familiar with eCommerce thanks to the power of technology. A whole process of shopping is now at the tip of a finger swiping on a smartphone. As a consequence, customers want the purchase process to be smooth as butter without any hiccup, such as payment gateway problems.

Bad experience turns prospects away, and the worst moment to do that is when they are trying to pay for some items. When their carts have been abandoned, they may never come back.

The good news is that there are many solutions out there that Shopify accepts and you can use it for your online store. In this article, we will look at all the best Payment Gateways for Shopify, as well as a list of available payment gateways for Dropshipping, US, UK, India and Australia.

Why you need Payment Gateways for your Shopify store?

We kind of have answered that question above, but let’s dig a bit deeper. Let’s learn about the general definition of the terms and all the advantage payment gateways can provide for your Shopify store.

What are eCommerce Payment Gateways?

Payment gateways, or also known as online payment processors, are used to facilitate transactions. These allow movement of information from a portal (like phone, website, or interactive voice response service) to payment processors such as banks.

The payment gateways exist to securely transmit the customer’s confidential payment date (which has a credit/debit card and bank account data) to a specific bank and return a response on whether the transaction has been accepted or declined.

As an online store owner, an eCommerce payment gateway is in charge of all your store’s transactions.

The responsibilities of an eCommerce payment gateway can also be verifying client accounts, analyzing velocity patterns, processing money, calculating tax amounts, and performing Address Verification System (AVS) checks.

For customers, the payment gateway will receive the details of their credit card, then deduct the amount spent and sen it the drop shipper’s bank account after including some fees.

Why is it important to choose the best payment gateways for Shopify?

As mentioned, without a payment gateway solution, your store can not make transactions with customers. For an eCommerce store, that is a big deal since you don’t sell products directly to your buyers.

And because the transactions involve large amounts of money, secure and reliable payment gateways will decide if buyers want to do business with you or not. The gateway is also a convenient way to manage transactions since all are recorded in one place.

Another worth-mentioning factor is that people tend to purchase through the methods that they are familiar with.

So if you have many payment methods or payment gateways, your prospects can easily find what suits them and ready to buy. This is helpful if you are targeting customers from some countries and they have a specifically preferred payment gateway.

Related:

Now you’ve understood why your Shopify store needs payment gateways, let’s see a list of the best gateways that you can choose.

Top 10+ Best Payment Gateways for Shopify

As a Shopify business owner, you should choose a payment gateway that has popularity and is acceptable in your country. These are the top 10 gateway solutions suitable for all Shopify stores:

1. Shopify Payments

Shopify has its own payment gateway solution which is Shopify Payment. You won’t have to set-up Shopify third-party payment gateways or merchant accounts since it is already integrated into your store.

If you are in the US, Canada, United Kingdom, Ireland, Singapore, Australia, and New Zealand, Shopify Payments is available with a few minutes of signing up.

The required information to activate are:

- Banking information

- Average shipping time of your orders

- Employer Identification Number (EIN)

- The average price of your orders

The solution also lets you manage business and financials from a single place which is the payment dashboard. And it accepts every credit card that customers use to purchase.

The best thing about Shopify Payments is that merchants are only charged with card swipe fees but not additional transaction fees. And this gets lower by upgrading your subscription plan:

- Basic Shopify: 2.9% + 30¢ for online credit card; 2.7% for in-person credit card

- Shopify: 2.6% + 30¢ for online credit card; 2.5% for in-person credit card

- Advanced Shopify: 2.4% + 30¢ for online credit card; 2.4% for in-person credit card

As the official solution, Shopify Payments is the most convenient way to do business transactions if you are a Shopify store owner. But the limitation of countries can be a down point.

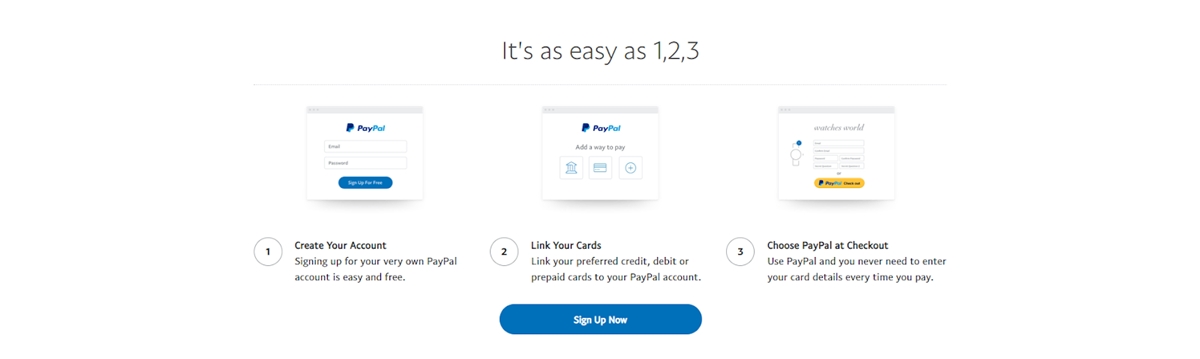

2. PayPal

Another famous payment gateway household name is PayPal, which is used in 200+ countries in the world and has more than 220 million active users. The tool is very easy to set up and give your store both options for free and paid merchants accounts.

PayPal is so well-known that many casual users have PayPal accounts for themselves and use the service to handle payments on the web or split bills with friends. This makes PayPal a must-have payment gateway, and Shopify suggests the enablement of PayPal Express Checkout in the settings as well.

For businesses, PayPal offers three different plans which are:

- PayPal Payments Standard with 2.9% + 30¢ per transaction

- PayPal Express Checkout with 2.9% + 30¢ per transaction

- PayPal Payments Pro with 2.9% + 30¢ per transaction plus $30 per month

Though most expensive, PayPal Payments Pro is the most preferred because it is stable, flexible and has mobile support. You can customize the entire checkout process with customers never leaving your site and not having a PayPal account.

But frankly, PayPal is not really cheap with an additional 3.0% charge for any currency conversion, and also a 1.5% international transaction fee to receive payments from another country. Not to mention additional fees from Shopify for using payment provider other than Shopify Payments.

The advantage is in the solution’s popularity. Your store can accept PayPal, Venmo, PayPal Credit, major debit cards and credit cards, just through PayPal Checkout.

3. Authorize.Net

Authorize.Net is one of the most versatile payment gateway providers on the market. Through it, you can accept all major credit cards, digital payment methods, debit cards, e-checks, and payments from most foreign countries.

The company has been around since 1996 and widely recognized as suitable for both small and large eCommerce businesses with different plans. The solution is also safe with fraud detection and data secured. You can also tokenize all the sensitive info.

The list of e-check payments that Authorize.net accepts is Visa, American Express, MasterCard, Discover, JCB, and Diner’s Club - all the most needed names. It also supports digital payment services like Apple Pay, PayPal and Visa Checkout.

Based on what you need, Authorize.net can issue invoices, simplified checkout process, or set up recurring payments.

Pricing for Authorize.net goes as following:

- All-in-One Option: for businesses without a merchant account; $25 per month and 2.9% + 30¢ per transaction

- Payment Gateway Only: for businesses with a merchant account; $25 per month and 10¢ per transaction

- Enterprise Solutions: for businesses that need to process more than $500K per year

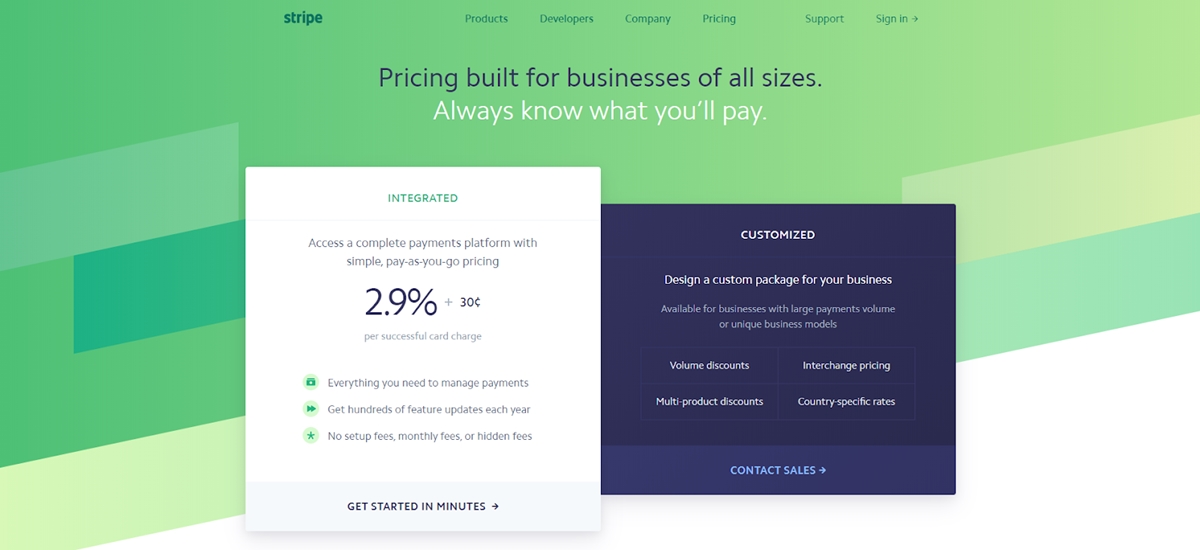

4. Stripe

Considered one of the best and popular gateways for Shopify users in the US, Stripe is a powerful and popular Shopify payment gateway. This is your go-to option for creating your own customized payment system.

What is special about it is that Stripe is a payment service provider, which means it provides a payment gateway for a merchant account that can be shared by multiple merchants.

Using Stripe, you can accept all major payment methods plus several foreign credit card networks and PayPal payments. It has a clear structure that works with all major e-commerce systems and a simple-to-use interface.

Moreover, Stripe is a developer-centered payment gateway so you can fine-tune Stripe to serve your business in any way you like with a bit of coding. You can build a branded payments page or make your own customizable transaction reports.

Stripe is now available in 30+ countries and works with 135+ currencies. The solution also guarantees transaction security, machine-learning fraud detection system, and high-class information encryption.

Stripe doesn’t have pricing plans, but rather than fees per transaction like this:

- 2.9% + 30¢ per credit card transaction within the US

- +1% when accepting international cards

- A $15 chargeback fee for a month-to-month contract

5. AliPay Global

AliPay GlobalAliPay Global is one of the leading third-party online payment solutions for Shopify users in China. If offers in-store payment, online payment, and a special QR code service.

The platform currently supports 12 currencies which are AUD, CAD, CHF, SGD, DKK, SEK, USD, GBP, JPY, EUR, HKD, and NOK.

Since you are surely going to do a lot of business with AliExpress, having AliPay Global can be an advantage to make things work better. The payment gateway is also safe and secure for millions of individuals and businesses to accept credit cards.

AliPay Global charges fees based on whether it is a solely domestic payment or an international transaction. If you are inside of China, the rate is close to zero, but for foreign countries, you will be charged a fee of 0.55% on the flip side to every purchase. The more money you transfer, the higher the transaction fee can be.

6. 2Checkout

2Checkouthas been around since 2006 and now available in over 180 countries. The solution can process payments online, manage your business’ finances, and have an advanced dashboard.

The payment gateway service is considered one of the best credit card gateways for Shopify, which supports Mastercard, Visa, American Express, Diners Club, and others.

Another special thing is that 2Checkout integrate their payment gateway with all popular e-commerce platforms, which helps your store easily accept 100 different currencies. You can also host your own checkout page, compile reports, customize your integrations using API.

2Checkout comes with three pricing plans and the following transaction fees:

- 2Sell: an easy way to sell globally; 3.5% + 30¢ per transaction

- 2Subscribe: for subscription-style business; 4.5% + 40¢ per transaction

- 2Monetize: an all-in-one solution to sell digital goods globally; 6% + 50¢ per transaction

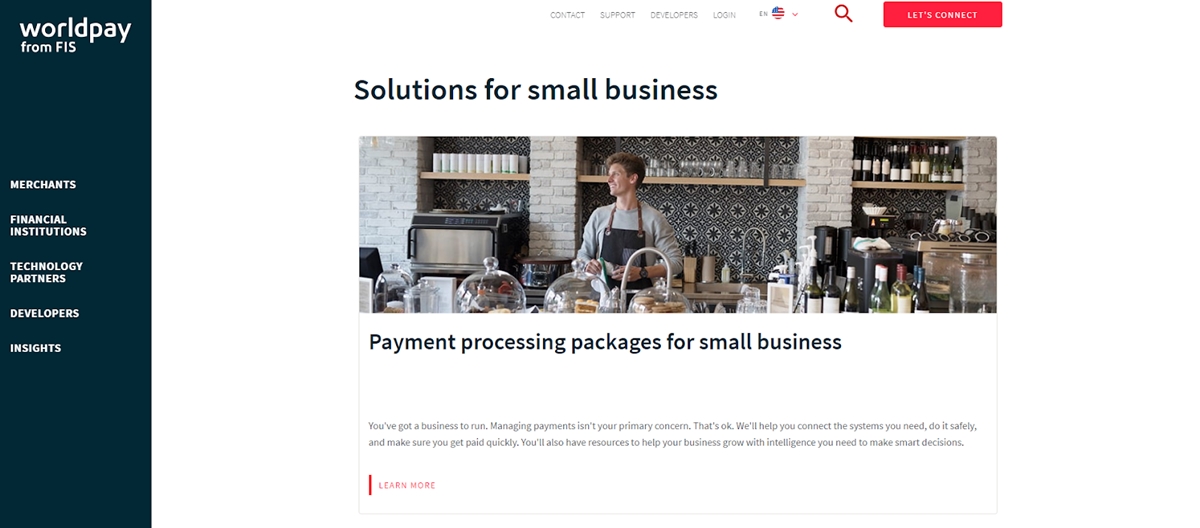

7. WorldPay

This is a Shopify payment gateway that is known as a secure payment service for small and large businesses, which helps process payments online, card machines and telephone. The platform is now available in 100 countries worldwide.

An advantage of Worldpay payments is that transaction fees are based on a sliding scale dependent on turnover for Shopify store owners. Which means users like you can cut costs depending on your success.

This is really helpful if you start as a small business and steadily scale up. And the platform receives PayPal as well.

WorldPay has pricing plans both for monthly fees and pays as you go:

- Pay as you go: 2.75% + £0.20

- Monthly: From £19.95 per month plus 2.75% (credit cards) & 0.75% (debit cards)

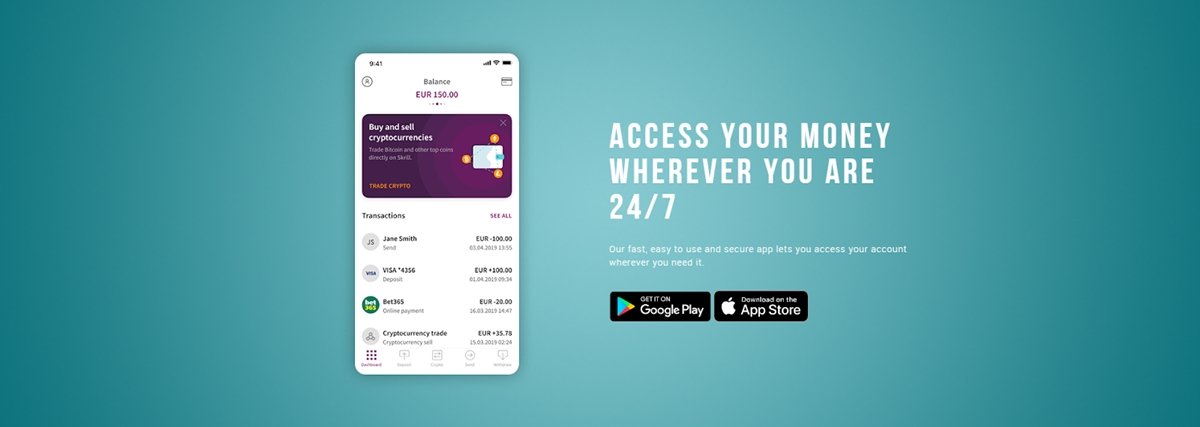

8. Skrill

Skrill is a payment gateway available in over 40 countries and offers an extension for easy integration with most eCommerce platforms. With it, you can request payments from customers with over 30 different currencies accepted.

The best part about Skrill is probably the low transaction fees, which is only 1% for a domestic transaction and 1.9% for each international transaction. This is much lower than other payment gateways.

The platform also proudly offers a quick, safe, and convenient way of making or receiving payments. Users with Skrill accounts can store money in Skrill’s digital wallet or send it directly to business bank accounts. Skrill also allows the store owner to add a buy button to a website.

9. AlliedWallet

AlliedWallet is another plug-and-play payment gateway provider that accepts over 100 payment methods like Visa, MasterCard, China Union Pay, Diners Club, Discover, Express.

You can simply embed a few lines of code into your Shopify store, and a sleek hosted payment window for your customers will be created. The payment gateway works with most eCommerce platforms and has 24/7 support.

No setup fees needed to start, and the transaction fees start at 1.0%+ 10¢ per sale.

Their pricing plans consist of two options:

- Turnkey solution: 1.0%+ 10¢ for per sale with just one-day setup

- Executive: 1.0% per sale plus multi-currency processing, real-time reporting, flexible layouts, you need to contact to know the price for this option

10. Sagepay

Sagepay is a well-known payment processing solution for Shopify business owners to accept payments securely online through the phone or using card machines. Users also get access to 24/7 telephone support.

The platform promises 99.9% uptime and industry-leading fraud tools at no extra cost, so your store has a reliable security solution. The working time is fast too, you should see your money in your bank within two working days after a transaction.

Even more, SagePay offers a flat monthly fee for many of their products with no transaction charges, and all the fees are transparent on their website. The payment gateway is used by over 50,000 businesses worldwide.

You can easily add a SagePay integration into your Shopify store with the following pricing plans:

- Sage Pay Flex: £20.90, Credit Card charged off 2.09%, Debit Card 0.74%

- Sage Pay Plus: £45 per month, Credit Card charged off 2.09%, Debit Card 0.74%

- Sagepay has payment price options for different payment methods like online, phone payments, invoice payments, and face-to-face payments.

Best Shopify Gateways for Dropshipping

A dropshipping business is not much different from an eCommerce store beside the fact that you don’t store any products or have a warehouse. This means you won’t need a person-to-person payment method, just a payment gateway to make transactions.

Related Posts:

- What Is Dropshipping? Is Dropshipping Profitable ?

- How to Start Drop Shipping on Amazon

- How to Start Dropshipping On eBay?

- How to Dropshipping with AliExpress?

This makes having the right payment gateway more important since it directly affects your income. And the right ones are the ones that people are using.

So a few criteria that you should look at before deciding on your online store’s payment gateway would be about popularity, transaction fee, compatibility, and convenience.

Below is a list of five payment gateways that I think are the best currently for a Shopify dropshipping store.

Paypal - The most popular payment gateway

Paypal has always been the most commonly used payment gateway by both merchants and online shoppers. It is accepted in more than 200 countries and supports all necessary credit cards like Mastercard, Visa, American Express, Citibank, and more.

If you are doing dropshipping worldwide, PayPal is badly needed for people to purchase on your site. With 220 million active users globally, many of your prospects may already have PayPal accounts.

The minimum fees for PayPal are between 1.9% and 3.4% of all transactions, plus an additional of between 2.0% and 0.5% from Shopify. Don’t worry, you can have more than just one checkout method to save on transaction fees.

PayPal offers three pricing plans which are:

- PayPal Payments Standard with 2.9% + 30¢ per transaction

- PayPal Express Checkout with 2.9% + 30¢ per transaction

- PayPal Payments Pro with 2.9% + 30¢ per transaction plus $30 per month

2Checkout - Complete payment solution

Another well-known payment gateway for dropshipping is 2Checkout - which is available in over 180 countries. The platform supports all major credit cards such as Mastercard, Visa, American Express, Diners Club, and others.

2Checkout goes with PayPal pretty well since they can cover most countries in the world, even less popular third world countries.

One notable thing about 2Checkout is that it gives you a complete solution to process payments online, including an advanced platform to manage your business’ finances, integration, hosted shopping cart. It can act as an upgrade to your Shopify store.

2Checkout comes with three pricing plans for you to choose:

- 2Sell: 3.5% + $0.35 per transaction

- 2Subscribe: 4.5% + $0.45 per transaction

- 2Monetize: 6% + $0.60 per transaction

Stripe - Developer-centered payment gateway

This is a US-based payment gateway and very popular among Shopify dropshippers in the US. Stripe is available in 25+ countries and supports all major credit cards. The platform comes with a handful of flexible tools to customize your store’s payment process.

You can do this because Stripe is user-friendly and very open to developers. It is designed with larger firms in mind and provides a range of API that allows you to create your own on-demand marketplace.

Stripe also supports over 100+ currencies and has valuable features like one-click checkout, mobile payments, and subscription billing. The development languages are supported including Python, Ruby, PHP, and Java.

Pricing:

- 2.9% + $0.30 per transaction

- 2.7% plus $0.30 for in-person credit card transaction (if you have Stripe terminal)

- +1% when accepting international cards

- A $15 chargeback fee for a month-to-month contract

Authorize.net - Most trusted payment gateway

What is good about being on the market for a long time? You have a lot of feedback to improve. That is why Authorize.net gains much credibility since they’ve been around since 1996.

The solution is available in more than 33 countries and accepts all major credit cards like Visa, Mastercard, Diner’s Club, Discover, American Express, JCB. Many large and small businesses have used Authorize.net for years.

You also have advanced fraud detection to prevent unauthorized payments or other forms of troubles. Your customer’s data is also stored securely and tokenizable with all the sensitive info.

The solution also supports digital payment services like PayPal, Apple Pay, and Visa Checkout.

Pricing:

- All-in-One Option: for businesses without a merchant account; $25 per month and 2.9% + 30¢ per transaction

- Payment Gateway Only: for businesses with a merchant account; $25 per month and 10¢ per transaction

- Enterprise Solutions: for businesses that need to process more than $500K per year

Skrill - Europe famous payment gateway

Finally, for Shopify dropshipping business, we have Skrill. This a large online payment gateway that is available in over 40 countries. The platform is popular among European and has an attractive transaction fee.

The platform takes pride in offering a convenient way of processing payments in a safe, and quick manner. All your to use is a Skrill account and a linked credit or debit card.

One cool thing about Skrill is that you get your own Skrill digital wallet - which can store money and send directly to your business bank account.

Skrill only cost a 1% transaction fee and 1.9% per international transaction (with 30 currencies available).

Best Payment Gateways on Shopify in the US

Now, we come to a country that is very active in eCommerce - the United States. But different from Amazon or eBay, a Shopify store should have a different payment gateway solution.

Since you are selling in the top eCommerce country of the world, a payment gateway that is popular and can help your business expanding is essential. And because your visitors may not have the best connection to your store, a good shopping experience can make them stay longer.

So here are two best payment gateways for Shopify stores in the US.

PayPal - Global payment gateway

Ah, the name we cannot avoid when talking about payment gateways, PayPal. With any Shopify plan, you can activate the Paypal Express checkout from the settings page. The process of setup is easy and can be done in less than a day.

As mentioned, the payment method is available in more than 200 countries with 220 million active users. Using PayPal with Shopify also offers functionalities like multiple customization options, easy cart integration, credit card payments over the phone, and online invoicing.

Shopify and PayPal have always been a winning combination, thanks to its popularity on the subcontinent and a simple setup process.

Shopify PayPal fees can be anywhere between 1.9% and 3.4% of all transactions with an additional $0.2

Stripe - Customizable payment gateway

Stripe is another powerful and popular Shopify US payment gateway which can reach to more than 30+ countries for your business and supports 135+ currencies.

With a clear structure, a good integration system, easy to use interface, and the ability to customize has made Stripe a favorite choice for businesses in the US. Stripe also guarantees transaction security and secure all transaction data safely.

You also have 24×7 support via email, chat and over the phone so it is safe to say your Shopify business is in good hands.

Stripe offers a basic plan with a flat fee of 2.9%, plus $0.30 per transaction. If you are a larger than usual company, there is a customized plan with a volume discount.

Best Payment Gateways on Shopify in the UK

Next up, we have eCommerce businesses in Great Britain. Many Shopify stores have thrived for being from the UK and have a taste in the style that suits buyers worldwide. So the choices for payment gateways are quite diverse.

Here is a list of eight top payment gateways that I think Shopify stores in the UK should use:

Worldpay - The UK’s choice for a payment gateway

Why do I call it the UK’s choice? Because half of all payments taking place in the UK are now being processed by Worldpay. The platform is available in 100 countries worldwide and accepts over a hundred currencies as well as major debit and credit cards.

Worldpay is also known for security since it has comprehensive fraud screening that protects you and your customers. That is a good thing for doing business with people all around the world.

Another noteworthy feature is that Worldpay lets you send payment links to customers, which means buyers can purchase without going to your website and save time for you on chasing invoices.

Transaction fees are based on a sliding scale, starting at 2.75% + £0.20 when you pay as you go. Monthly plans start at £19.95 per month plus 2.75% (credit cards) & 0.75% (debit cards).

Authorize.net - Payment gateway for all store sizes

From Visa, Authorize.net is a great payment gateway for Shopify stores in the UK and can fantastically streamline your payment process. The platform provides tools for you to sell items and take payments both in an online method and in-person purchase.

It supports all essential credit cards like Visa, Mastercard, Diner’s Club, Discover, American Express, And JCB. Authorize.net is considered suitable for all small and large businesses with different pricing plans.

The platform is also widely recognized as the most trusted payment gateways for Shopify stores, and have several features like customer profiles, eCheck processing, card tokenization.

You have three pricing plans to choose from, but the most popular one is the all-in-one option for businesses that don’t have a merchant account. If you selected this, you would be charged $25 per month and 2.9% + 30¢ per transaction, no setup fee needed.

2Checkout - Ease of use payment gateway

2Checkout is available in more than 87 countries and is a popular option for payment gateway in the UK. The platform is one of the best credit card gateways for Shopify and supports Visa, Mastercard, American Express, and more.

The platform is like a complete solution to process payments online with an advanced platform where you can manage all your eCommerce transactions. It also can localized checkout for supported countries, making your store more appealing.

2Checkout has 3 plans to choose, but “2Sell” is probably the best for Shopify stores. You can signup for free and start selling globally with a transaction fee of 3.5% + 30¢ per successful sale.

Shopify Payment - Official Shopify payment gateway

If you want to eliminate the transaction fee and you are in the UK, Shopify Payment is the answer. You will only be charged for the subscription fee in addition to the card swipe fee.

Shopify Payments also provides POS kits so you can sell at your store or on the way. The clean-cut features help you manage your store’s transactions from a single place.

To activate Shopify Payments, you will need to provide the following information: Banking information, Average shipping time of your orders, Average price of your orders, Employer Identification Number.

Then, your store is good to go and start accepting credit cards from all over the world. Shopify Payments is free for Shopify store owners.

SagePay - Secured payment gateway

Proudly come from the UK, SagePay is used by over 55,000 businesses worldwide. The platform offers a full range of payment gateway solutions for every size of business.

The monthly fees are flat and transparent, so you can see exactly how much you are going to spend. SagePay is among the best payment gateways for Shopify in the UK and trusted for security as well as reliability.

You also get access to MySagePay -which gives you a clear view of how your transactions are looking. And you can take payments over the phone too.

The transaction fees vary between £19.90/month for 350 transactions per month to £45/month if you purchase 500 tokens.

Amazon Pay - Connecting platforms

Amazon Pay is Amazon’s payment gateway - which helps you receive online payments with one of the most famous brand’s names on the planet. The process of checkout is simple as well just like you are paying on Amazon’s website.

And since your prospects may already have an Amazon account - since 310 million people already have - the details they need to provide and purchase are reduced considerably.

The tool also has many eCommerce tools that can help you sell goods efficiently, and a top-class frau detection technology that shields you from bad transactions.

Amazon Pay has no hidden cost, and you only pay for the transactions you make. The processing fee range from 3.4% to 1.4% based on your monthly volume from less than 1,500 to above 55,000, plus an authorization fee of $0.20 for all volumes.

Best Payment Gateways on Shopify in India

Across the world, India is probably one of the fastest-growing countries in eCommerce, so there is no doubt we should have some payment gateways suitable for the country.

Cashfree - India’s complete payment solution

Called themselves a complete payments toolkit for India, Cashfree is used by over 15,000 businesses for a full-stack payment solution.

The platform has ready to use plugins for Shopify stores, and you can start accepting international payments right the way. Cashfree supports all the major credit cards like Visa, MasterCard, Diners Club, and can work with PayPal or other payment gateways.

Using Cashfree, you will be charged with a 1.75% transaction fee per successful sales, which is acceptable for businesses in the area.

Paypal - Worldwide payment gateway

If you are a Shopify store owner in India and want to expand your business to the world, then PayPal is a must-have payment gateway. Used in 200+ countries in the world and has more than 220 million active users, your international visitors would appreciate if you had PayPal.

You can set up PayPal for your Shopify store in less than a day and start doing business worldwide right the way. Using PayPal with Shopify also provides easy cart integration, online invoicing, credit card payments over the phone, and multiple customization options.

PayPal fees can be anywhere between 1.9% and 3.4% of all transactions, scaling based on your store’s volumes of transactions.

-

Related articles:

- Shopify Hide Paypal Button Apps

- Shopify India Pricing Plans: Our Comprehensive Details

PayU Money - Trusted payment gateway

PayU Money is founded in 2002 and now available in 17 countries. They are reported to serve more than 450,000 merchants and supports over 100+ payment methods just in India.

The platform also has high-grade security to ensure your transactions’ safety and worked with large companies like Netflix, Airbnb. It has some additional features like saved-card feature, auto OTP read as well.

You can easily integrate PayU Money into your Shopify store and start accepting transactions from all around the world. The transaction fee is flat 2% GST (18% of 2%) for each transaction.

See more: 9 Best Shopify Payment Gateways in India

Best Payment Gateways on Shopify in Australia

Shopify made its way to Australia, and it is no surprise since eCommerce businesses in the country have been very active recently. While Shopify Payment is now available for Australian as well, here is a list of four best payment gateways for Shopify stores in the continent.

eWay - Most used payment gateway in Australia

Having been around since 1998, eWay is one of the most popular payment gateways in Australia. The platform has over 250+ shopping carts and software integrations for you to advance your store.

eWay also has built-in fraud prevention tools, secure and robust API, and workable with all major credit cards as well as digital wallets. To sign up, you only need to provide Australian ID and bank account details, then your account should be ready to use in 2-3 business days.

For transaction fee, you will be charged 1.9% + 20c per transaction (both domestic and international cards). There are three budget plans for you to choose ranging from $20 - $60 per month.

Pin Payments - An easy-to-use payment gateway

Launched in 2011, Pin Payments gives you a flexible platform for accepting card payments from customers. They provide a recurring billing service and fraud protection tools to keep transactions safe for both sides.

Any credit cards from Visa, Mastercard, American Express are supported by Pin Payments, and customer card can be verified before processing order, which makes things easier to purchase. You don’t need a merchant account to start accepting payments.

For transaction fees, you will be charged at different rates for domestic (1.75% + 30c) and international transactions (2.9% + 30c).

Braintree - Global payments

Braintree helps you accept payments from more than 45 countries with 130+ currencies, quite impressive. The platform also has global commerce tools for you to build your business, accept payment, and provides in-depth reporting.

In 2019, Braintree now has in-store payments, allowing you to receive payments from your physical stores as well.

Their standard pricing is 2.9% + 30c per transaction, and a flat $15 fee is assessed for each chargeback. The price is quite high in my opinion but they can have the most number of countries among Australia’s best payment gateways for Shopify stores.

Factors to consider when choosing the best Payment gateway

Having seen all the best names, you must be a bit overwhelmed with the information. The decision on which payment gateway is still entirely up to you, so I would help with a few criteria that you should look at when considering.

Target market: Which is the payment gateway that is popular in the region or the country that you are targeting your products? This should be considered first if you want to sell globally.

Transaction fees: This affects your profit margins directly, so take a bit time to see how much is a payment gateway monthly pricing, setup fee, refund fee, and any other fees needed.

Business goals: You should have clear ideas on how your store should be in the future, like keep expanding to more countries or stop after some regions have been reached.

Processing speed: The faster the better, this ensures that the user experience is amazing by eliminating the time-wastage if lag times happens because of the gateway portals.

Fraud protection: Last but not least, make sure the customer and your store’s data is safe. This not only leads to better approval rates but also less chance of problems in the future.

Final Thoughts

Congratulation you on reaching this far, hope you could find an answer to which payment gateways you should choose for your Shopify stores. I tried to be as detailed as possible in the hope that this article can be a helpful assist to you.

The right selection of payment gateway will ensure a smooth payment process, so your customers and your business can walk happily together. Not to mention the reliability and security required in doing online transactions.

What do you think? Have you found your ideal choices? Is there any payment gateway you would like to add? Leave comments below to let me know and I would answer them right the way.

As usual, best of luck on your eCommerce journey!

Read more: Shopify Plus Calculator: Breaking Down Shopify Enterprises Plan

New Posts

People also searched for

- best payment gateway for shopify dropshipping

- payment gateway for dropshipping

- best payment gateway for dropshipping

- payment gateway dropshipping

- skrill dropshipping

- best payment processor for dropshipping

- dropshipping payment gateway

- best payment gateway for shopify

- authorize.net dropshipping

- best dropshipping payment gateway

- 2checkout dropshipping

- shopify payments india

- dropshipping payment processor

- dropshipping payment methods

- best payment gateways for dropshipping

- best payment gateway for shopify usa

- dropshipping payment

- best shopify payment gateway for india

- shopify uk payment gateways

- shopify payments for india

- 2checkout dropshipping agreement

- best payment gateway australia

- best payment gateway uk

- shopify payments vs paypal

- stripe dropshipping

- best payment gateway india

- shopify payments vs stripe

- best payment gateway for international transactions in india

- best payment gateway for international transactions

- shopify payment solutions

- shopify payment gateway australia

- best payment gateway for shopify uk

- drop shipping payment system

- payment gateways australia

- best payment gateway europe

- best international payment gateway for india

- best payment gateway worldwide

- shopify payment australia

- paypal dropshipping