What is An Invoice? Invoice Definition and Function

When studying business, you might see the term “invoice” come with high frequency. When receiving a delivery box, you will also see a paper titled “invoice”, with a list of your ordered products from the suppliers. The process of invoicing might be time-consuming, but it can’t be skipped or ignored at any cost.

In this article, we will go through the concept of an invoice to get some in-depth understanding of invoice importance, functionality, and applicability in general transactions.

What is an invoice?

An invoice is a document that records the products and services that businesses provide to their clients and establishes the obligations that the clients have to pay for those products and services. In other words, an invoice certifies the agreement between providers and clients on purchases of goods and services, and it will create an account receivable for the providers.

Types of invoices

There are several types of invoices based on your business scale or your products and services provided.

- Standard Invoice - This is the most common form of invoice that is applicable in almost every industry, and it is often created by small businesses to cut down on invoice preparation costs. A standard invoice includes the basic elements of an invoice, such as name and contact addresses, invoice number and the payment amount due.

- Debit invoice - A debit invoice is used when there arises an increase in the amount that the customers owe businesses. In other words, this type of invoice makes it easier to adjust the existing bill. For instance, you work as a freelancer. You sent your client an invoice that estimated your working hours on a certain project, but you actually worked extra hours in the end. In this case, you can send your client a debit invoice for the additional working hours billed. A debit invoice will always include a positive total number.

- Credit invoice - A credit invoice, also known as a credit memo, is issued by businesses when clients demand a discount, or refund, or when they ask to fix the mistakes in previous invoices. A credit invoice will always include a negative total number. For example, when your customers demand a $100 refund on a certain product, the displayed number on the credit invoice will be -$100.

- Commercial invoice - Unlike any invoices or bills that are normally received at offline retail stores or restaurants, commercial invoices are specially issued by businesses for foreign trade. Basic commercial invoices contain required details that verify typical international sales, including shipment quantity, volume, packaging format, product descriptions, payment method, and machine parts. As for the custom ones, there might be some additional elements such as country origin, carrier ID number, and authenticity verification notes/signatures.

- Timesheet invoice - This type of invoice is regularly used in the employment industry. A timesheet invoice is used when an employee is evaluated in a time period (usually per hour) by their employer. The type of invoice is more preferred in intellectual professions other than technical ones and is mostly provided to psychologists, business consultants, creative agencies or lawyers. The timesheet invoice is also commonly applied for rental services, such as car, costume or cooking utensil rents.

- Past due invoice - When the payment date (stated in the initial invoice) is due and the client still hasn’t provided the payment, businesses will issue a past due invoice as a way to renew the payment. The past due invoice should be sent right after the clients miss the payment due date. And apart from the services purchased and total costs, interest charges or delay / late fees are included as well.

- Recurring invoice - The recurring invoice is issued by businesses to charge the clients the same amount due periodically. At first glance, it might sound similar to the interim invoice, but there are some key differences between to distinguish. While the interim allows you to break the total payments into small periods for a large project with a definite end, the recurring invoice is issued rather indefinitely. This type of invoice is preferred by businesses that provide monthly package services, such as IT software or social media marketing solutions.

- Pro-Forma invoice - A Pro-forma invoice will be sent to your clients before the services are provided. It is not a request for payment but more like a reminder for payment or an estimation of the final costs for the work done. The estimation, however, is fairly exact and usually, there are barely any changes made in the final transaction.

- Interim invoice - The interim invoice is normally used for large and time-consuming projects with multiple milestones. A freelancer or business will send their invoices to the clients once a key milestone has been completed. These invoices will break the sum of payment into smaller pieces, which will be beneficial for managing your business’ cash inflow.

- Final invoice - As the name has implied, the final invoice is the last invoice sent to your clients when a certain project is completed to request for payment. This invoice will be more detailed than the Pro-forma or interim invoice as you will have to include everything you have provided your clients and the total balance due as well.

Related posts:

Invoices vs. Bills

The difference between invoices and bills lies in the standpoint of the suppliers and the clients. An invoice, as mentioned in the previous section, is the document recording that the products and services are produced and sent to the customers. It can be delivered before or after the products are received. Usually, shipping companies would include the invoice in the delivery box so that customers can double-check the items they order.

A bill, however, is more like a request for payment. Commonly, a bill is printed and delivered to the customers before they pay to ask for immediate payment. This form of documentation is mostly included without an invoice in restaurants or offline retail stores.

Invoices vs. Receipts

Invoices are used to request payment from buyers, keep track of sales, help control inventory and facilitate the delivery of goods and services. In some special cases, businesses invoice to estimate their revenues as well as suggest payment options for their customers, such as cash payments, discounts for “early birds”, installment payments or extended-time payment.

A receipt is documentation that payment has been made to finalize a sale. Sometimes, keeping a receipt might prove that you are the owner of a certain product. It lists goods or services, prices, credits, discounts, taxes, the total amount paid and method of payment. Receipts are used by buyers or customers to prove they paid for an item, especially in situations where they demand to get a refund for defective or faulty products.

Invoice and receipt recipients are normally customers, but accountants, bookkeepers or third parties will especially receive receipts as proof of customer payment for future financial and accounting purposes.

Invoices vs. Purchase Orders

People usually get confused in distinguishing invoices with purchase orders (POs), but the difference is actually significant. The most recognizable one is that purchase orders are made before transactions, while invoices are made after transactions. A purchase order is made to verify orders from customers, then sent to the providers. Businesses also use purchase orders to approve the specific amount of products and services needed for supply as well.

On the other hand, an invoice will record the receipt of products and services, along with their prices and payment terms. In other words, an invoice is the final “response” to the purchase order; and while a purchase order details a sale contract, an invoice confirms it.

What is an invoice number?

An invoice number, also known as an invoice ID, is a unique code assigned to each invoice. The invoice number is one of the most crucial factors of invoicing as it is documented to clarify individual transactions between businesses and their clients and make it easier to keep track of payments and conduct accounting tasks as well.

Without the invoice number, the invoice will have no legal validity. An invoice number can include both numbers and characters. Remember that even when the invoice number is not necessarily generated sequentially, make sure that the numbers do not repeat one after another.

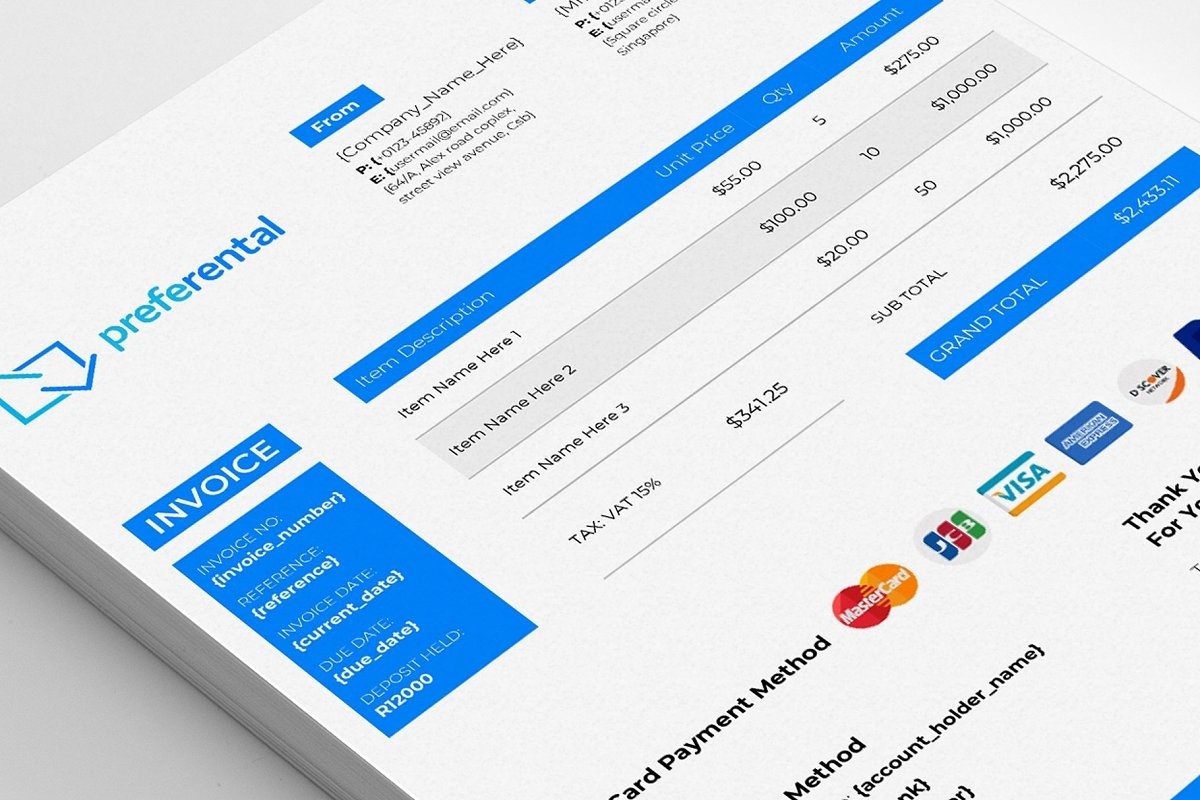

What does an invoice include? - A sample of invoice

Different types of invoices include different elements. However, there are some compulsory components to legally activate an invoice:

The dates

There are three types of dates to put in an invoice: date of supply, date of invoice and payment due date. While the date of supply and date of invoice only has a function of informing when the products and services are issued and when an invoice is created, the payment due date holds a much greater significance. Without the due date, there’s no guarantee that you will be paid on time and get the account receivables.

Names and addresses

You will have to add both your business and your customers’ names and addresses. If you use accounting software to generate invoices, only customer email addresses are needed, but it’s still necessary to collect the physical address in case your clients demand an offline document being sent to them.

Contact names

Make sure to include the contact names of both your businesses and individuals and spell them correctly. Incorrect spelling would lead to unwanted frustration and worsen the customer experience.

Invoice number

The invoice number is extremely essential for purchase record tracking and database filing, so make sure to include a uniquely numbered one to optimize your invoice management process. For higher certainty, consider using a subsequent numbering system.

Purchased items details

The purchased items include both products and services. A specifically-detailed description of products’ names and quantities will help in avoiding unworthy confusion between suppliers and customers. Without this information, customers may not know what their received invoice is for, and they may not make the payment.

The amount due

It might seem obvious, but this element has a determining role in avoiding payment delay. Specify the purchased items’ prices, units, and total costs, and don’t forget to put them in the sum.

Terms of payment

These terms are usually marked at the bottom of the invoice to notify the customers about the length of time to pay. For example, you can specify with “net 30 days”, implying that the payment must be made within 30 days.

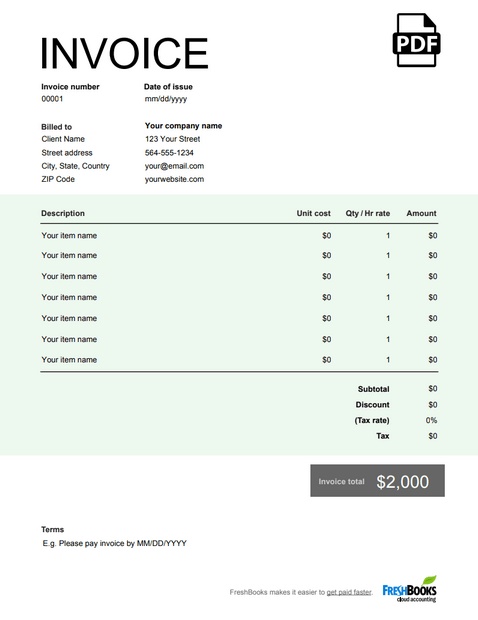

You can take a look at this standardized invoice sample to get a more concrete look.

What is an invoice used for?

Businesses need to deliver invoices in order to demand payments. An invoice is a legally binding document presenting both parties’ agreement to the set price and payment terms and conditions. Besides, using invoices can help more than just that.

Maintaining records

An invoice has a determining role in keeping sales records. This makes it possible to find out about the goods sold and who is involved in the transactions.

Payment control

An invoice also has an indispensable role for accounting purposes. It helps both the seller and the buyer to keep track of their payments and amounts owed.

Legal protection

A proper invoice is proof of agreement on a price involvement between the seller and the purchaser. Therefore, it has legal validity to protect the merchants from committing fraudulent lawsuits.

Tax filing

Recording and maintaining all sale invoices helps the company report its income and ensure that it’s paid the proper amount of taxes.

Business analytics

Invoice analysis can help businesses collect data from their customers’ buying behaviors and identify consuming trends, popular products, buying timing prime, and many others. This will help your business to later come up with the ultimate marketing strategies.

How to invoice your clients?

Businesses can utilize both online invoice generators or a pre-print invoice for later usage. You will create an invoice only after you have delivered the products or services to your customers, or when you have completed a project. That’s when you keep the details of the work fresh in mind, and you can get a higher chance of getting paid in time. To invoice your clients smoothly, you can follow this guideline:

Step 1: Clarify customers’ expectations in the contract

To ensure you get paid promptly, make clear your payment terms before your client signs a contract. The process of ‘clarification’ should be conducted as a thorough conversation other than just a pre-print discussion. By learning their expectations, you can also discover if they have any special requests, and that will help reduce the rate of unpaid invoices and prove your willingness to accommodate customers’ payment preferences.

Step 2: Identify the to-deliver items

You would have to include the names of the products and services with their quantity or rate. If you are using online software, the total for each item is calculated. Each item gets its own line, and the total of all lines is added.

Step 3: Ask for a deposit

For a large purchase, it’s necessary to get paid a deposit to ensure that your clients will pay the invoice on time. Normally, a new customer tends to be hesitant about the price which poses a high chance that they will delay the payment due date. Asking for a deposit at this time is the most suitable to avoid frustration in the future.

Once your customers pay for the deposit, include the information in the invoice. Feel free to add any discount information as well.

Step 4: Clarify payment terms and offer different payment methods

If you want to make sure that you get paid on time, you should strictly clarify the payment terms at the bottom of the invoices. Customers tend to neglect or ignore the section of the payment terms contract before claiming a bill, so you should include late payment terms to ensure your customers will pay on time and avoid unwanted situations where clients claim that they were unaware of the payment due date or extra late fees.

When a customer pays, the invoice number should be noted on the sales receipt and matched to the sales receipt in your accounting software, so it’s clear that the invoice has been paid. The payment takes the outstanding amount out of your accounts receivable account.

Step 5: Send the invoice promptly

Invoices may be mailed or emailed or faxed to a customer. To get paid quickly, deliver the invoice as soon as possible. This keeps your business at the front of your client’s mind. It also shows that you’re attentive to details, which once again guarantees that your business is the best choice for the chosen services.

Online invoicing over paper-based invoicing

The method of creating invoices with papers and pens has gradually been replaced by online invoicing, with the help of technology. A paper-based invoice is estimated to cost businesses up to $30 dollars from preparing, printing, and processing to delivering and after-sale customer service.

However, what businesses and their customers experience is not equivalent to the high cost - delayed invoice delivery, difficulty in invoice management, and unwanted arising mistakes. Due to this inconvenience, many businesses have conclusively used cloud-based invoicing approaches to cut down on costs and accelerate the invoicing process. Nowadays, most invoices are created and sent on the digital platform.

How to create an invoice?

Step 1: Select an invoice creation approach

As mentioned in the previous section, both traditional and technological invoice creation methods are still parallelly in use nowadays. But obviously, the digital-based invoicing approach holds a more considerable advantage over the paper-based system tracking invoices. Use a database program or invoice-generating software if you plan to use a computer for invoices.

Learn more about AVADA PDF Invoice

Learn more about Mageplaza PDF invoice for Magento 2

Step 2: Create a template for your invoices.

You should leave some empty spaces in the very first part of the invoices to include your customers’ contact addresses and their company names. A standardized invoice should contain some basic information such as the customer’s purchase date, the list of purchased items with their quantity and total prices, and an optional description of the items as well.

Step 3: Add your company name and address

Leave a space at the top of your invoice sheet for your company’s logo when using automatic invoice generating software. The rule is similarly applied for paper invoicing - paste a business card at the top of the invoice copy. The letterhead of the invoice helps your customers identify your company and benefit your filing process.

Step 4: Create a signature space at the bottom of the invoice

Signatures are proofs of verification to help your business avoid legal problems in the future. For instance, in case your clients make any complaints about the prices after the services are delivered, you can show them their signature on the invoice referring to the initial agreement.

Step 5: Insert an invoice number at the top

Every invoice needs a unique invoice number for better tracking and filing. If you have a problem with a customer, you can look for their invoice copy from your database files by scanning the invoice number at the top of the invoice copies.

Final words

Once you become familiar with invoice definition and function, you will find the process easy enough to help you appear more professional on behalf of your business, get paid faster, deal with mistakes or problems more sensibly and manage your products and services more efficiently.

Besides understanding the core concept of invoicing, putting the process into practice is just as important. The best way is to take advantage of modern technology, by using online invoice generators or e-invoicing, to minimize unnecessary efforts and get optimized final outcomes.

Read More:

New Posts