How to Value a Small Business

When it comes to selling or buying the business, valuing your company turns into so important that you wish you know how to do this earlier than ever.If you are planning to sell, merge the business, buy out other owners, apply for a business loan, or anything related to a business’s life cycle, you need to be concerned about proper small business valuation. There are different acceptable business valuation methods. Choosing a suitable way for yourself depends on your industry, size, circumstances of sale, or purpose of the valuation.

Understanding the need to know How to value a small business, we have this article that will present why you should value your business and guides to make it happen correctly. From that, you can surely do an accurate business valuation for your own company.

Why do you need to value your business?

A question has arisen whether it’s necessary for a small business to do a valuation. The answer is YES. There are many reasons that you need to value your business no matter how large your brands are. If you are going to buy or sell businesses, it is undoubtedly crucial for you to consult a number and determine the value of your business. But even in terms of the situation when you don’t intend to sell, knowing how to evaluate and determine the value of your own can still help you understand your company’s index or draft out your company’s roadmap for future strategies.

Though valuing the business is for everyone, this article will focus on those having a small business. Knowing the methods and why the outcomes change is essential for small business owners or corporate executives. Most of the purposes are relevant to the changes in the business of its owners. However, some personal reasons or individual events still have a significant impact on the valuation.

Estimating the value of the business is required anytime there are purposes or financial events within a business’s lifetime, such as raising a new round of funding, applying for small business loans, transferring ownership, etc. For instance, SBA loan eligibility is contingent in part on the valuation that your business achieves, along with its overall financial health as derived from at least the past two years of tax returns. It’s about proving your company is a viable candidate for lenders to back, rather than a risky proposition. Some critical situation and purposes that you need to value your business may include:

- When you desire to sell your business

- To attract more investors

- When you are about to buy out the other owners

- When you offer employees equity

- When you have to apply for a loan or line of credit

- To know more about your business’s financial growth

- To serve tax-planning purposes

When evaluating your business’s value, you set aside personal feelings to build up a realistic, suitable, and competitive selling price. To be specific of what you need to prepare and do during the evaluation process, let’s come to the main parts to know more about these rules or thumb.

How to value a small business?

Preparation

You might think that you can do it on your own. It is valid as long as you are conducting the valuation just for informal purposes. On the other hand, if you want your company to be evaluated with serious matters, especially this is your first company, you should hire a professional appraiser or business valuation services provider expert to get a more accurate number. In both cases, you need a good preparation before evaluation. Here are some steps you can take to prepare

Step 1: Understand your valuation

Before starting doing the main job, it is necessary you get to know some key definitions first.

Seller’s Discretionary Earnings (SDE)

A more familiar term is EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), which stands for a business’s pure net profit. However, if you already knew this definition, you must have been familiar with SDE (Seller’s Discretionary Earnings). SDE is also used to determine the value of a business for a new owner. SDE will typically include all expenses that its company generates, such as reported income to the IRS, non-cash revenue. Nonetheless, the owner’s salary and benefits are also added to the SDE calculation, which does not happen with EBITDA. Though having the same use, EBITDA is often used by large businesses to do the valuation. In contrast, the small ones tend to apply for SDE because owners of these companies seem to have personal benefits added.

To set your SDE:

- Add your pre-tax and pre-interest earnings first

- Add back in the unnecessary expenses for operations like traveling or vehicles

- Add your employee outings, charitable donations, one-time purchases, and owner’s salary

Knowing what SDE is is crucial for sellers, but prospective buyers also need to understand this term before making such a huge purchase. Receiving a number from business owners, buyers need to raise questions of why and how they can reach that value.

SDE Multiples

As you have read earlier, SDE points out the actual value of your business. SDE multiple, on the other hand, evaluate your company based on industry standards. Like SDE, SDE multiple is used mostly by small business owners because they tend to set a large percentage of the company’s revenue for the owner’s salary and personal expenses. The higher your SDE multiple of business is, the more your business is worth. There is no fixed number of SDE multiple, but it varies according to market volatility, business location, business’s size, assets. etc.

Step 2: Organize your financial documents

This step will make it less complicated to determine the value of your business. Whether you are going to hire a business broker to do your part or go it alone, you all need to set your finances in order and organize them first.

Find and make sure these documents mentioned below are up to date. They may include:

- Licenses, deeds, etc.

- Profit & Loss statements for the last three or five years.

- Tax filings and returns

- A brief overview of your business or individual finances

Other documents may be included to ensure the evaluation flow smoothly are sale reports or industry forecasts.

Sometimes, business owners want to have copies versions of business licenses, permits, deeds, or certifications. They can then use these documents anytime to attach to any contracts with insurers, creditors, vendors, and clients. Not only business owners, but also buyers should organize the financial records. Buyers seem not to require all these documents but they still review their finances. Remember to organize and make your financial documents to be confident in your main calculations.

Step 3: Take stock of your assets

Now, it’s time to list your business’s tangible and intangible assets to your balance sheet. However impossible it seems to be, you still can clarify a number estimating your entire business. Therefore, if you are a seller, let’s consider all kinds of equity and put a number to what you operated over time.

What you need to do is listing the production, property, and resources that make up your business—assets and liabilities, cash and investments, employees, and intellectual property. This list makes the evaluation more fluent and is used to find a counselor, a mentor, or a professional business advisor. They will give your business advice and insight with an objective perspective because when doing it alone, you tend not to put your thought aside. Business owners can use this list to build an overview of your company’s value.

As a seller, you need to follow steps to take stock of your assets properly:

- Make a detailed report of your business assets and liabilities

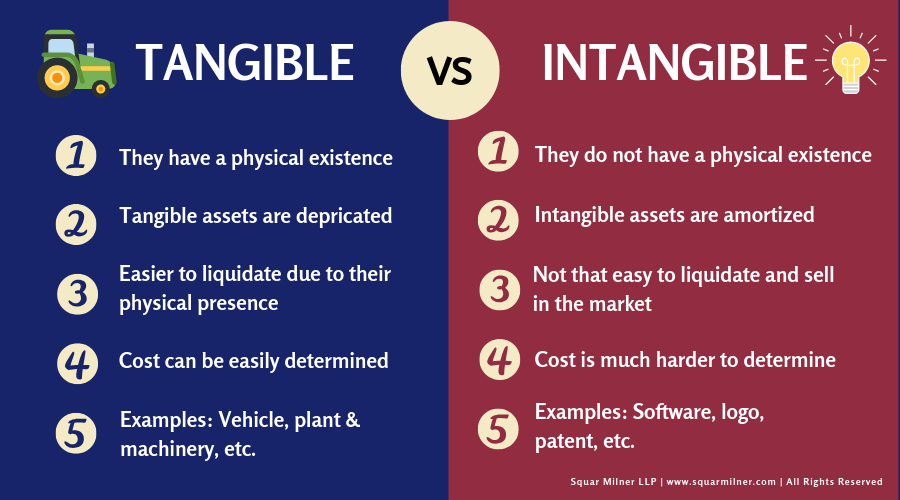

Business assets are all adding value to your company. There are two asset categories, which are Tangible assets and Intangible assets. Tangible assets are the company’s material resources and holdings like real estate or property, equipment or means of production, inventory or stock, cash on hand. In contrast, Intangible assets are non-material assets, which may include patents, copyrights, and trademarks, other intellectual property, brand and reputation, customer loyalty, or subscriber base.

When it comes to your liabilities, which are any debt or outstanding credit on your business’s books. Liabilities may include notes payable, accounts payable, business loans, accrued expenses, other mortgages or payables, unearned revenue, etc.

- Outline your business plan and model

Besides, you also should search for business plans which outline the processes and management entirely.

A business plan is what will project earnings and market growth for your company. It is essential because your buyers will request to know more about your business’ future, possibilities it will continue to grow and turn a profit. The content within the business plan to give buyers includes the company’s location, missions, and the key services you offer.

The business model helps point out how your company generates revenue (a subscription-based service, direct-to-consumer eCommerce, or B2B consulting). It is a tool to persuade potential buyers to purchase your company because it shows them how they will reach the customer base to make money.

Step 4: Research your industry

This step is a part of Marketing formative research that will give you a deep understanding of the industry. If you are a seller, being familiar with all trends and information of the industry, you will easily create an informed valuation that presents not just your business’s revenue but also the current market.

Because SDE’s multiple and the evaluating methods vary based on many factors, sellers need to research the relevant businesses that have something in common, like business’s size, model, or revenue (in case that information is available and accessible).

Researching and knowing clearly about your competitor will offer context about the sector. By doing that, you can assess your market share and growth potential and have clues to highlight what makes your company stand out among many peers.

Value your business

Now it’s high time for you to step in determining your company’s value. However, you need to consider first which method to choose to create the right valuation. Remember, for whatever method you choose, the key to a solid valuation is the objective process of accurate accounting, a reasonable estimating. Or else, the underestimation will lead to your low understanding of your company and industry, losing potential buyers, and harm your profit.

It is recommended you make fact-based earnings projections to value your small business in an accurate. In particular, you should focus on determining the assets and liability objectively

Here we will show you the three most common valuation methods recommending you to take into account. Each method bases on different aspects of income, assets, or industry of the business to calculate its value in number. Be free to hire an accountant for extra help if you found it too much to handle alone. Your total number is the final result of consistent calculations. Which means you should not mix formulas while calculating. Let’s plug your earnings amounts into many different formulas that can make comparisons before running to the final decision.

Income approach

The first approach is related to the amount of income a company will generate in the future. This approach includes two other smaller valuation methods:

-

Discounted cash-flow method is which shows the value of a business’s future cash flow. The purchasing process of a company does not prevent itself from some risks. Then these risks will decide the business’s cash-flow forecast. Discounted cash-flow method (or Adjusted cash-flow method) is used by every business but likely to be applied by newer companies with a high growing possibility but not profitable yet.

-

Capitalization of earnings method calculates the likeliness to get profitable in the future of a company based on the business’s cash flow, rate of returns every year (or ROI), and its value expected. Unlike the method mentioned above, the earnings method’s capitalization does not present the fluctuations in the financial perspective. Still, it assumes that the evaluation at any time will likely continue in the future. Therefore, this method is used mostly by those with stable profitability.

In general, most online businesses choose one of two methods within the approach when it comes to the income approach. But it doesn’t mean you also have to follow their steps. You can try a more comprehensive valuation solution in the calculation with profit, revenue, assets, and liability if you own more financial information available.

Asset-driven approach

This approach is one valuation method that depends completely on the business’s asset. To be more specific, the Asset-driven approach differentiates between a business’s assets (such as equipment, property, inventory, and intangible assets) and its liabilities. Using the asset-based method, you will have a chance to control your spending and capital resources.

To do this assessment, you need to make a list of your assets first and set a monetary value. That value is different based on kinds of assets. This number is often between the sale price and depreciated value when it comes to equipment or relevant assets. One rule to remember is using the number representing how much a part of equipment would sell for today.

IIf you are looking for liquidating or the business you own does hold investment or real estate, this assessment is suitable for you. After that, these kinds of the personal value of your investments or equipment can be appealing to potential buyers. Once you get used to your equipment and production, it can give you some benefits. Firstly, it is more likely that you reach an accurate evaluation of your asset’s value and depreciation. Also, you can get a good understanding of the current market and business’s material value.

Market approach

This approach is valuing a company according to the purchases and sales of similar companies in the same industry. Based on the local market, you can build your suitable selling or purchasing price of your business. A business with a desire to use this approach has to gather enough relevant data to compare its business with comparable ones. This approach can be used by anyone serving the condition mentioned but turns into more useful for businesses and industries with high growing speed.

How to improve the value of your business?

When you are about to sell your business, you need to be concerned about how to improve its value to provide the highest potential for future profit. Many business owner seem to get surprised and disappointed when finding the value of their company not as high as expected. Therefore, the owner should start working on improving the business’s selling price as soon as possible. To increase the value of your business, you need to consider these factors:

- Prepare enough documentation of at least 3 years of your company’s profit growth.

- Remember to add clues claiming that the business is well-organized and running fluently because potential buyers expect to have a smooth transition into the new business instead of launching from the beginning. When consumers find the working process and system be taken in place and likely to maintain after the owner leaves, they will be willing to accept a higher selling price

- Potential buyers will likely be appealing to the business with multiple helpful services and pieces of equipment like an up-to-date machine with a package of sufficient financial records, agreement of health and safety regulations, available client base, and employee policies etc.

- Do seller financing to increase the selling price, collected interest, and fields of buyers

- Hiring an appraiser or business evaluator helps you know more clearly about your business’s SWOT (Strengths - Weaknesses - Opportunities - Threats). Moreover, a professor in business valuation will advice on improvement according to their objective attitudes.

- Highlight the plus points of your company to make it apart from others within the same industry, such as responsible and capable employees.

Summary

To sum up, whether or not you are about to sell your business or buy other owners, you need to research and know how to determine a business’s value. This process will help you get to know more about your business’s financial situation in the context of your industry. Moreover, by doing so, you can identify any unexpected market turns or inbound offers.

We hope this post is helpful for you to start considering doing the business evaluation. No matter what purpose you set price to your companies for, remember to create an accurate number in hand, which makes you confident.

New Posts