How to set your tax rates in Shopify

Setting your tax rates correctly in Shopify is essential for running a smooth and compliant online store. For many store owners, understanding how to configure these rates can be challenging, especially when dealing with different regions and regulations. In this guide, we’ll walk you through the process of setting up tax rates in Shopify, ensuring your store is ready for seamless transactions.

How to set your tax rates in Shopify

For the Venture and Boundless themes, this tool does not support. For the products with only one variant, the prices will be updated through JavaScript or in a selectCallback function.

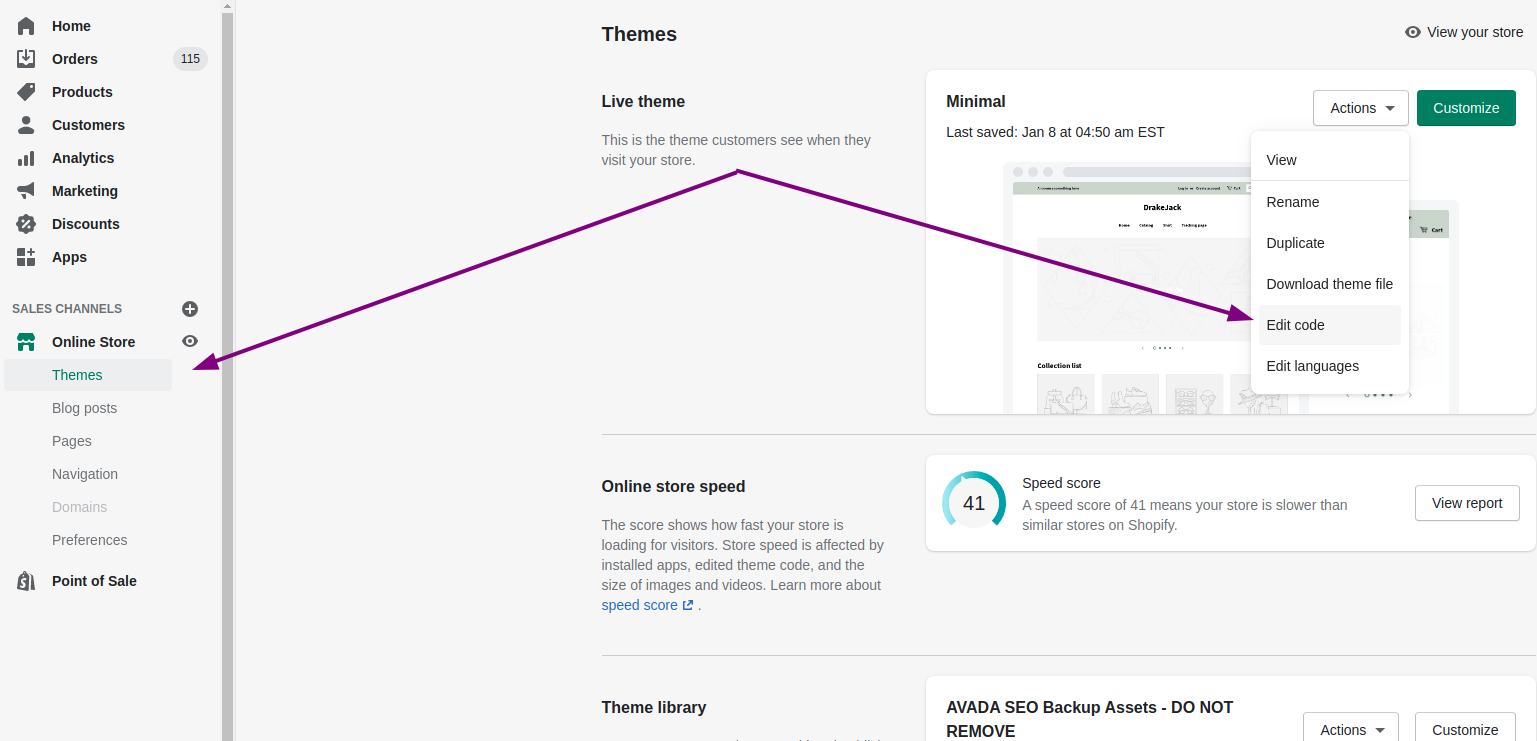

Step 1: Go to themes

The admins come to the Shopify admin, after that, they will click to Settings and then Taxes.

Step 2: Edit the code

At the Tax rates section, the store owners continue clicking on the name of their countries to adapt to that tax rate.

Step 3: Come to Assets directory

At this step, the store owners scroll down to Tax Settings to ensure that all taxes which are included in my product prices checkbox.

Step 4: Save changes

Press Save to save any change.

Conclusion

To conclude, setting your tax rates in Shopify may seem complex at first, but by following the steps outlined in this guide, you can easily configure them to meet your store’s needs. Remember to adjust your tax settings according to regional requirements and regularly review them to stay compliant. With Shopify’s built-in features, managing taxes becomes a smooth process, ensuring accuracy and compliance for your online store.